Image 1 of 3

Image 1 of 3

Image 2 of 3

Image 2 of 3

Image 3 of 3

Image 3 of 3

Classifying Business Expenses

Take Control of Your Business Expenses with Confidence

Are you overwhelmed by the confusion around classifying your business expenses? This guide is here to eliminate the guesswork, giving you the clarity you need to properly classify your expenditures and ensure your business is on the right track.

Why Proper Classification is Critical For Your Business

Misclassifying your expenses can lead to inaccurate financial statements, misinformed business decisions, and potential issues with tax authorities. A single misstep can result in compliance risks, cash flow mismanagement, and even penalties. This guide ensures you have the knowledge and tools to classify expenses correctly, so you can optimize deductions, stay compliant, and maintain accurate financial records.

How This Guide Will Help You:

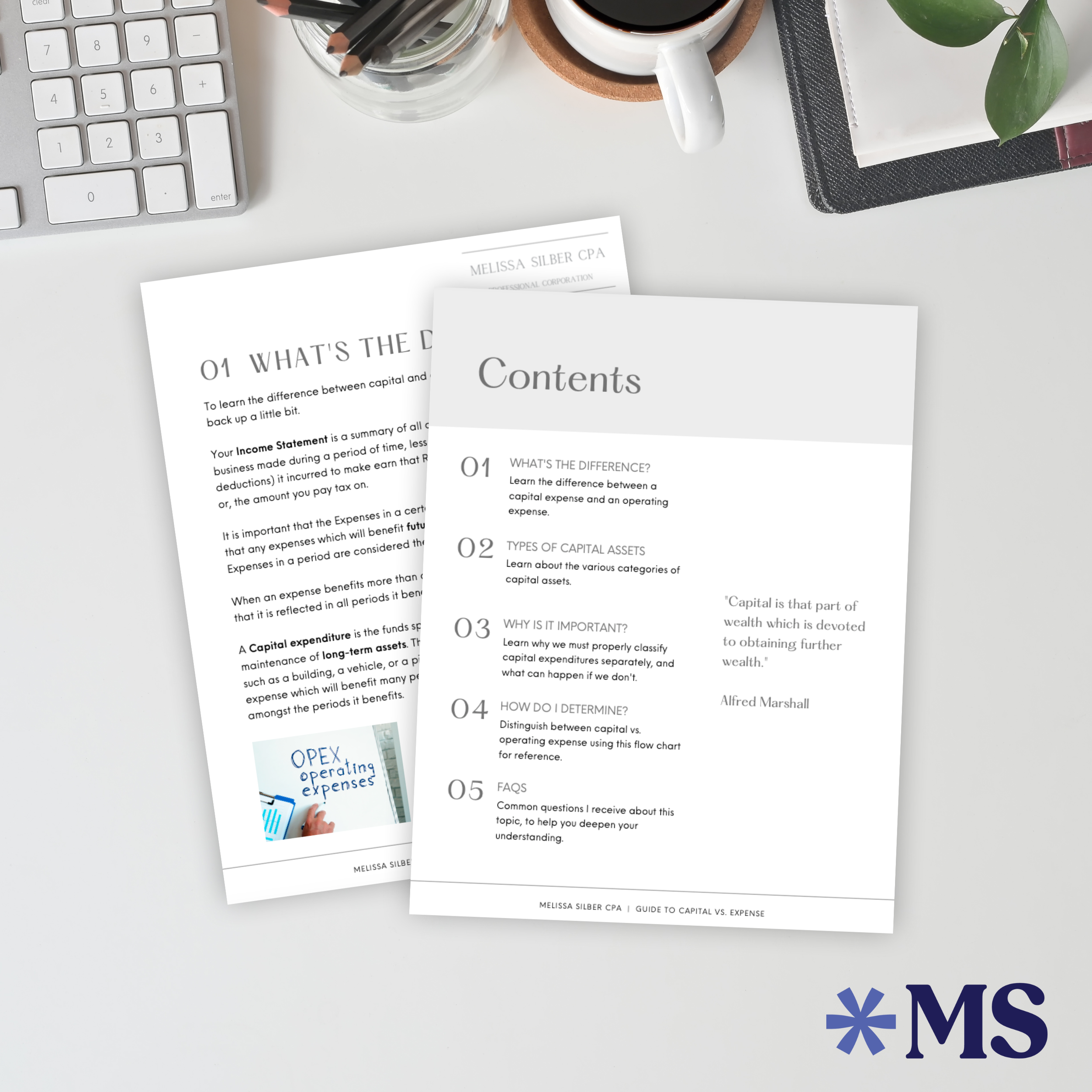

Gain Clarity on Your Expenses: Understand the difference between capital expenditures and operating expenditures, so you can confidently categorize your spending and avoid costly mistakes.

Make Informed Decisions: Learn why accurate expense classification matters for your business and how it affects your financial reporting, cash flow, and tax obligations.

Easy-to-Follow Flow Chart: With a convenient flow chart included, you’ll have a quick reference to help you determine whether an expense should be capitalized, giving you peace of mind when making financial decisions.

Learn More On The Blog

For more insights on managing your finances effectively, check out these relevant blog posts:

The Difference Between Capital Assets and Expenses: Dive deeper into how capital assets impact your business and why proper classification is so important.

What the HST?: Learn how expense classification affects your HST filings and what you need to know to stay compliant.

Audit Survival: HELP! How Do I Handle a CRA Audit?: Discover how proper expense classification can protect you during an audit and ensure your records are accurate.

Take Control of Your Business Expenses with Confidence

Are you overwhelmed by the confusion around classifying your business expenses? This guide is here to eliminate the guesswork, giving you the clarity you need to properly classify your expenditures and ensure your business is on the right track.

Why Proper Classification is Critical For Your Business

Misclassifying your expenses can lead to inaccurate financial statements, misinformed business decisions, and potential issues with tax authorities. A single misstep can result in compliance risks, cash flow mismanagement, and even penalties. This guide ensures you have the knowledge and tools to classify expenses correctly, so you can optimize deductions, stay compliant, and maintain accurate financial records.

How This Guide Will Help You:

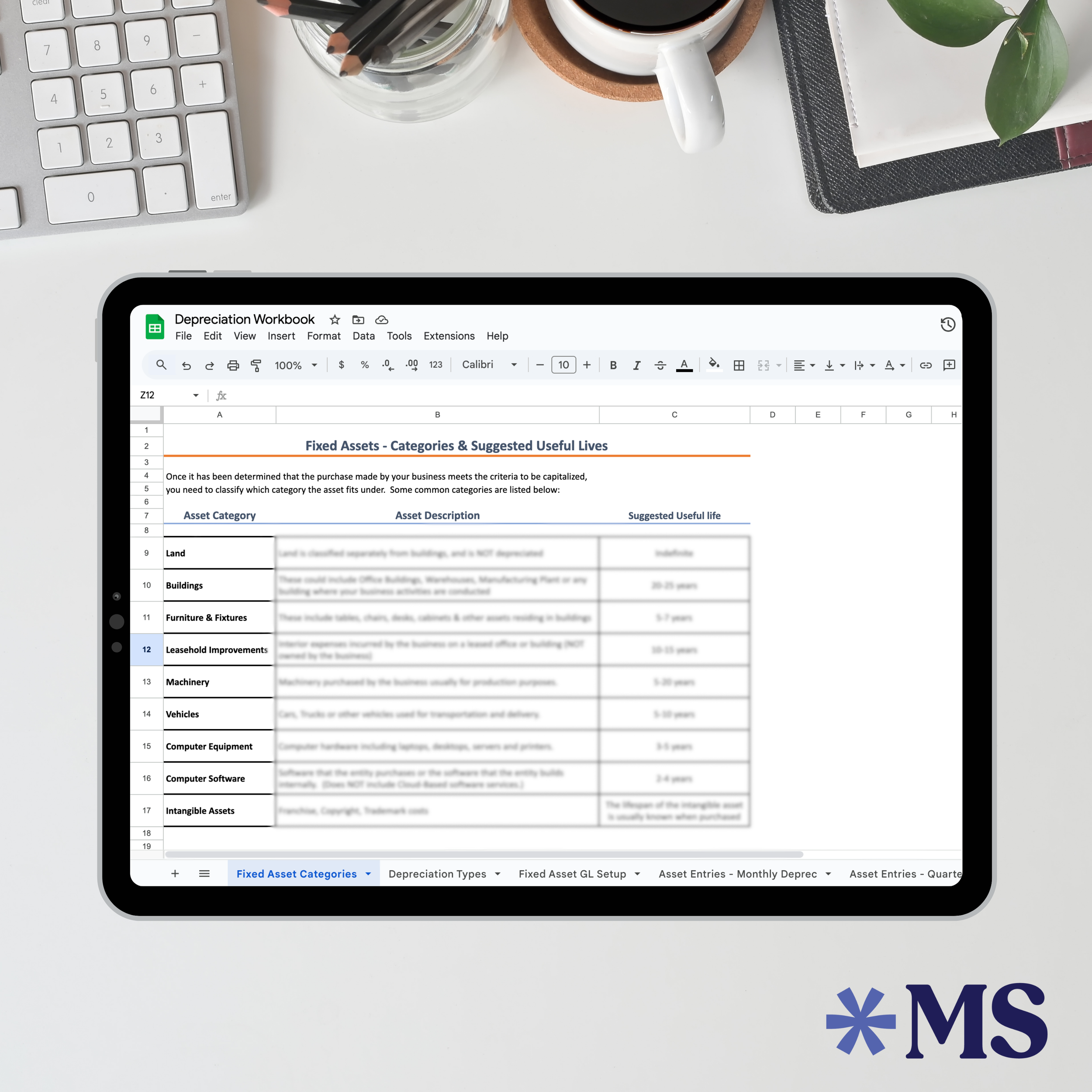

Gain Clarity on Your Expenses: Understand the difference between capital expenditures and operating expenditures, so you can confidently categorize your spending and avoid costly mistakes.

Make Informed Decisions: Learn why accurate expense classification matters for your business and how it affects your financial reporting, cash flow, and tax obligations.

Easy-to-Follow Flow Chart: With a convenient flow chart included, you’ll have a quick reference to help you determine whether an expense should be capitalized, giving you peace of mind when making financial decisions.

Learn More On The Blog

For more insights on managing your finances effectively, check out these relevant blog posts:

The Difference Between Capital Assets and Expenses: Dive deeper into how capital assets impact your business and why proper classification is so important.

What the HST?: Learn how expense classification affects your HST filings and what you need to know to stay compliant.

Audit Survival: HELP! How Do I Handle a CRA Audit?: Discover how proper expense classification can protect you during an audit and ensure your records are accurate.