Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

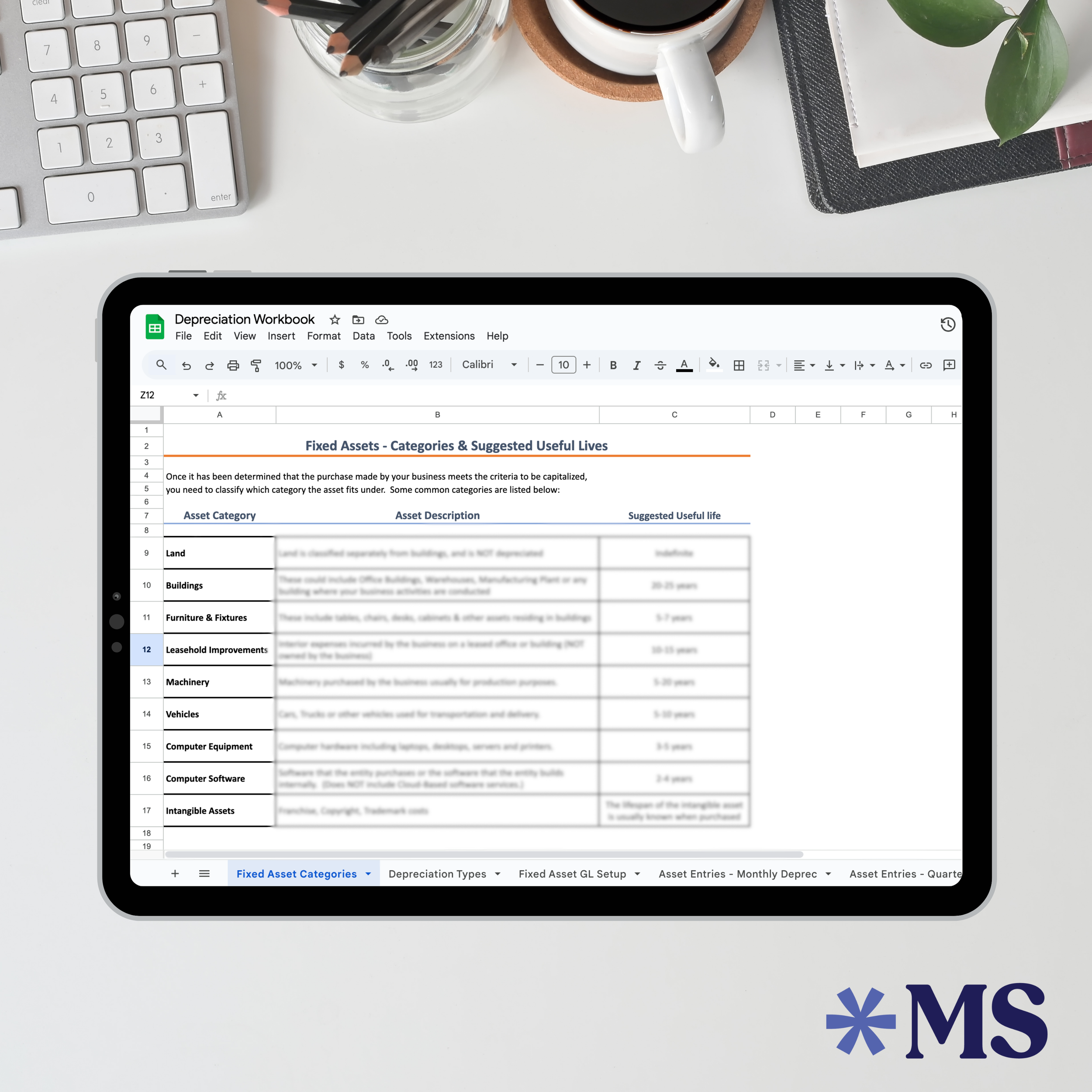

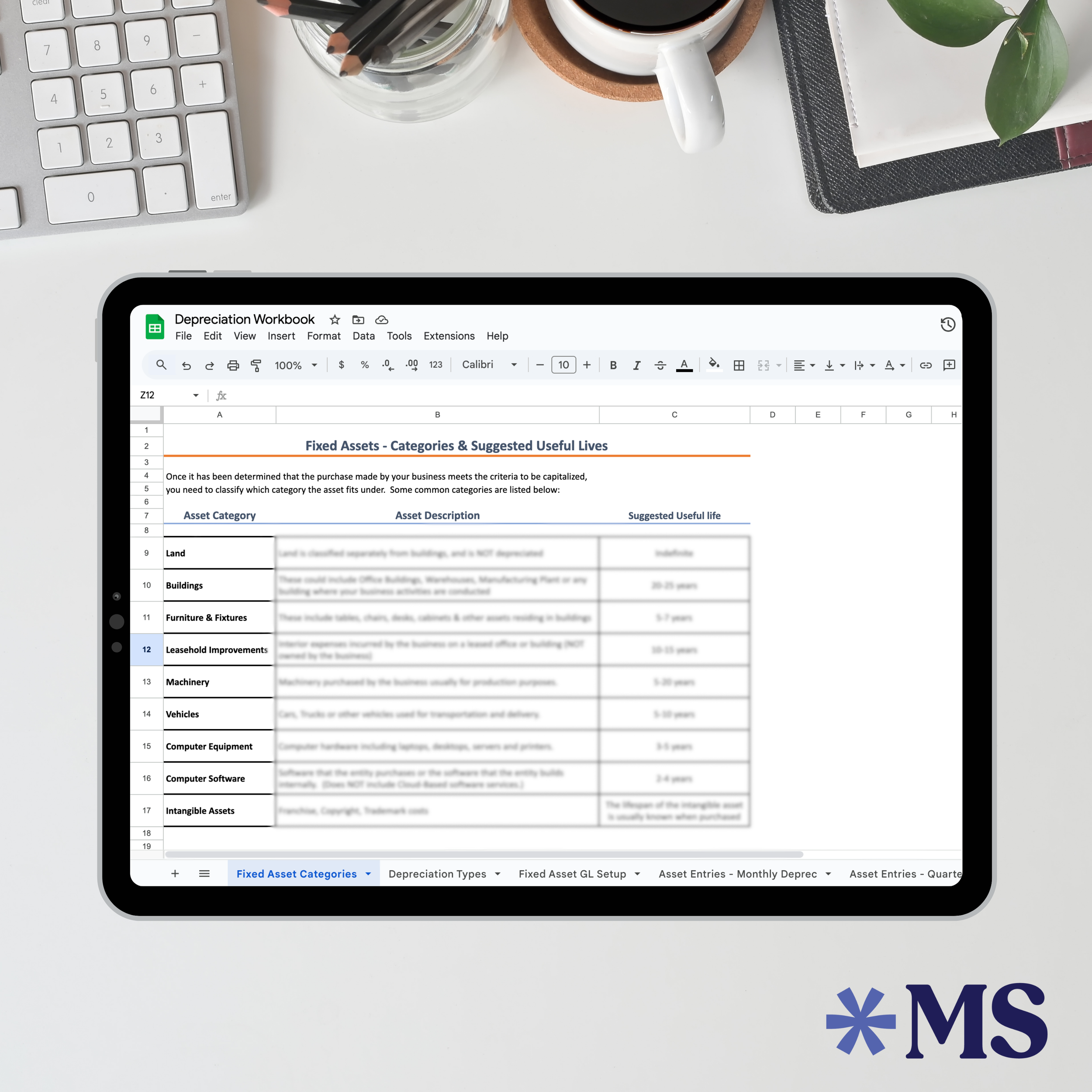

Depreciation Workbook

Simplify Depreciation and Stay on Top of Your Financials

Are you a small business owner managing your own finances? This workbook makes fixed asset management effortless, helping you track depreciation with ease. Whether you're handling equipment, property, or other assets, this tool saves you time, minimizes errors, and ensures your financial records stay accurate - so you can focus on growing your business with confidence.

Why Asset Management Is Essential For Your Business

Asset management is critical for accurate financial reporting, and ensuring that your depreciation is calculated correctly can have a big impact on your bottom line. This workbook empowers you to streamline your accounting process, reduce errors, and maintain compliance without needing extensive accounting knowledge.

How This Workbook Will Help You:

Save Time and Reduce Errors: Eliminate the hassle of manual calculations with automated depreciation expense calculation and journal entry creation, so you can focus on growing your business.

Stay Organized and Informed: Easily categorize your fixed assets and ensure your financial records are accurate with General Ledger guidance, giving you peace of mind when it comes to tax time or audits.

Customize to Fit Your Business: Choose the frequency of your depreciation entries that suit your specific reporting needs - whether quarterly or monthly - giving you full control over how your financials are presented.

Learn More On The Blog

For more tips on mastering your financial management, check out these blog posts:

The Difference Between Capital Assets and Expenses: Learn why managing your assets properly impacts your tax deductions and overall financial health.

The Numbers Don’t Lie… But Do You Know What They’re Saying?: Discover how understanding your financial reports can help you make better business decisions.

The Finance Silo: What is one of the biggest obstacles that an organization can face?

Simplify Depreciation and Stay on Top of Your Financials

Are you a small business owner managing your own finances? This workbook makes fixed asset management effortless, helping you track depreciation with ease. Whether you're handling equipment, property, or other assets, this tool saves you time, minimizes errors, and ensures your financial records stay accurate - so you can focus on growing your business with confidence.

Why Asset Management Is Essential For Your Business

Asset management is critical for accurate financial reporting, and ensuring that your depreciation is calculated correctly can have a big impact on your bottom line. This workbook empowers you to streamline your accounting process, reduce errors, and maintain compliance without needing extensive accounting knowledge.

How This Workbook Will Help You:

Save Time and Reduce Errors: Eliminate the hassle of manual calculations with automated depreciation expense calculation and journal entry creation, so you can focus on growing your business.

Stay Organized and Informed: Easily categorize your fixed assets and ensure your financial records are accurate with General Ledger guidance, giving you peace of mind when it comes to tax time or audits.

Customize to Fit Your Business: Choose the frequency of your depreciation entries that suit your specific reporting needs - whether quarterly or monthly - giving you full control over how your financials are presented.

Learn More On The Blog

For more tips on mastering your financial management, check out these blog posts:

The Difference Between Capital Assets and Expenses: Learn why managing your assets properly impacts your tax deductions and overall financial health.

The Numbers Don’t Lie… But Do You Know What They’re Saying?: Discover how understanding your financial reports can help you make better business decisions.

The Finance Silo: What is one of the biggest obstacles that an organization can face?